Large firms and companies frequently employ NWC in their finance departments. Changes in working capital are reflected in a firm’s cash flow statement. It might indicate that the business has too much inventory or isn’t investing excess cash. Alternatively, it could mean a company fails to leverage the benefits of low-interest or no-interest loans.

Growth Rate

The amount of working capital needed varies by industry, company size, and risk profile. Industries with longer production cycles require higher working capital due to slower inventory turnover. Alternatively, bigger retail companies interacting with numerous customers daily, can generate short-term funds quickly and often need lower working capital. The benefit of neglecting inventory and other non-current assets is that liquidating inventory may not be simple or desirable, so the quick ratio ignores those as a source of short-term liquidity. Yes, technically capital lease liability would be considered more like short-term debt than an operating liability like accounts payable. The rationale for subtracting the current period NWC from the prior period NWC, instead of the other way around, is to understand the impact on free cash flow (FCF) in the given period.

What is a Good Working Capital Cycle?

Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. For instance, if NWC is negative due to the efficient collection of receivables from customers who paid on credit, quick inventory turnover, or the delay in supplier/vendor payments, that could be a positive sign. As for accounts payables (A/P), delayed payments to suppliers and vendors likely caused the increase.

Positive vs negative working capital

- One common financial ratio used to measure working capital is the current ratio, a metric designed to provide a measure of a company’s liquidity risk.

- So, let’s perform these four simple steps one by one with me for calculating changes in the NWC of Walmart Inc.

- Industries with longer production cycles require higher working capital due to slower inventory turnover.

- Working capital represents the financial resources available to businesses to fulfil their short-term obligations and sustain day-to-day operations.

- You’ll need to tally up all your current assets to calculate net working capital.

- Therefore, the working capital cycle is a practical method to analyze the operating efficiency and liquidity of a particular company, including its near-term risks.

- That is, you need to use discounting and compounding techniques in capital budgeting.

However, only the current assets change with the change in the level of sales revenue during the short-run. This means you have a great amount of flexibility in managing the current assets of your business. In this article, you will learn about managing current assets that act as a source of short-term finance for your business. Further, you will also learn what is Net Working Capital and how to calculate Net Working Capital. Negative working capital means assets aren’t being used effectively and a company may face a liquidity crisis. Even if a company has a lot invested in fixed assets, it will face financial and operating challenges if liabilities are due.

Working capital in financial modeling

These include short lifespan and swift transformation into other forms of assets. Given those initial assumptions, a potential interpretation – in the absence of industry data – is that the weak point in the company’s business model is the collection of cash from customers who paid on credit. For the most part, a shorter working capital cycle is perceived positively as a sign of operational efficiency, and vice versa for a longer cycle.

- Working capital is critical to gauge a company’s short-term health, liquidity, and operational efficiency.

- Working capital is a core component of effective financial management, which is directly tied to a company’s operational efficiency and long-term viability.

- These companies need little working capital being kept on hand, as they can generate more in short order.

- This is a good sign for the company because it is trying to keep its money accessible and ready for use.

- Generally, the higher the ratio, the better an indicator of a company’s ability to pay short-term liabilities.

- Pvt Ltd has the following current assets and liabilities on its balance sheet dated 31st December 2019.

- By implementing efficient billing and collection processes, businesses can accelerate cash inflows and reduce the risk of bad debts.

What Is the Formula for Cash Flow?

The difference between this and the current ratio is in the numerator where the asset side includes only cash, marketable securities, and receivables. The quick ratio excludes inventory because it can be more difficult to turn into cash on a short-term basis. Some accounts receivable may become uncollectible at some point and have to be totally written off, representing another loss of value in working capital. It may take longer-term funds or assets to replenish how to find change in working capital the current asset shortfall because such losses in current assets reduce working capital below its desired level. Examples of changes in net working capital include scenarios where a company’s operating assets grow faster than its operating liabilities, leading to a positive change in net working capital. With credit limit up to Rs. 50 lakhs, businesses can apply for working capital loans from Razorpay in just three simple steps at zero collateral.

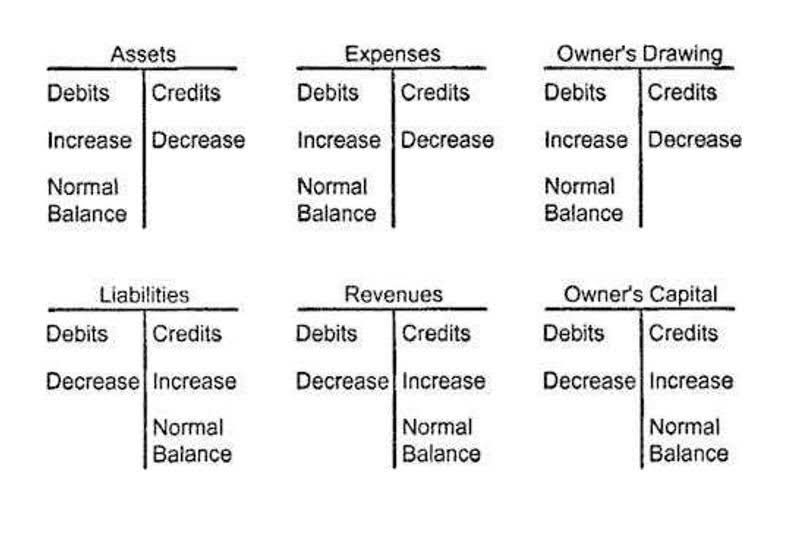

Positive change indicates improved liquidity, while negative change may signal financial difficulties. Working capital represents the financial resources available to businesses to fulfil their short-term obligations and sustain day-to-day operations. It encompasses various components, including cash, inventory, accounts payable, accounts receivable, and short-term debt. Current assets include assets a company will use in fewer than 12 months in its business operations, such as cash, accounts receivable, and inventories of raw materials and finished goods. Current liabilities include accounts payable, trade credit, short-terms loans, and lines of credit.

Q: What is change in working capital on the balance sheet?

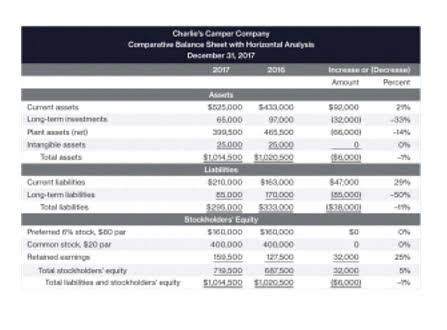

The working capital cycle matters because the change in net working capital (NWC) impacts a company’s free cash flow (FCF) profile and liquidity. Therefore, the working capital cycle is a practical method to analyze the operating efficiency and liquidity of a particular company, including its near-term risks. Calculating working capital requires building a model in Excel and using data from a company’s income statement (IS) and balance sheet (BS). Additionally, since accountants prepare financial statements that include the information required for the NWC, they may easily calculate and monitor NWC for customers. Mr. Arora is an experienced private equity investment professional, with experience working across multiple markets. Rohan has a focus in particular on consumer and business services transactions and operational growth.

Recent Comments