Below are the T accounts with the journal entries already posted. Post the transactions to the income summary account and close the income summary account. Distributions has a debit balance so we credit the account to close it. Our debit, reducing the balance in the account, is Retained Earnings. Its use as an organizational skill is underlined by how it summarizes all the necessary ledger balances in one value instead of a single account balance.

Single-Step vs. Multiple-Step Income Statement

For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. This is because lenders want to know the ability of the company to generate revenue and profit, as well as its capacity to repay the loan. Income statements also provide a good source of analysis for investors that are willing to invest in the business. It provides them with a summary of the performance of the company during a specific period.

Permanent Versus Temporary Accounts

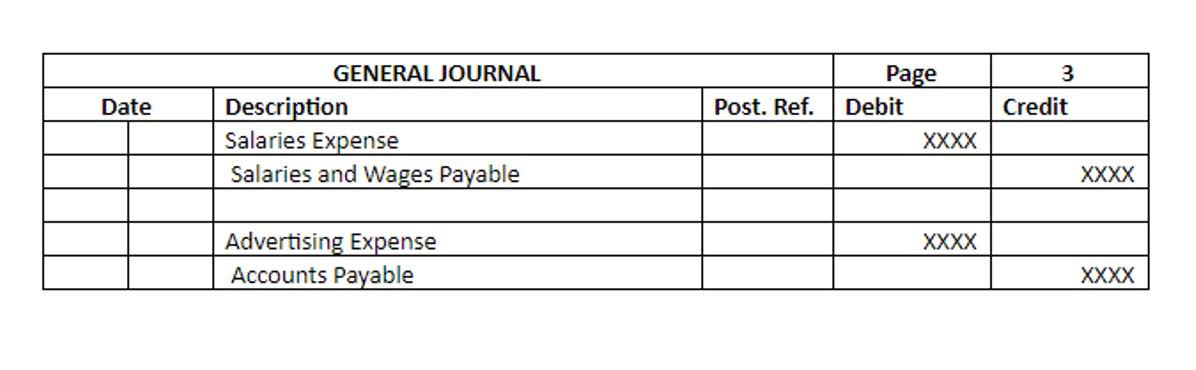

The income summary account is an intermediary between revenues and expenses, and the Retained Earnings account. It stores all of the closing information for revenues and expenses, resulting in a “summary” of income or loss for the period. The balance in the Income Summary account equals the net income or loss for the period. This balance is then transferred to the Retained Earnings account.

Closing Entries Using Income Summary

- Operating expenses are basically the selling, general, and administrative costs, depreciation, and amortization of assets.

- If the balances in the expense accounts are debits, how do you bring the balances to zero?

- You will notice that we do not cover step 10, reversing entries.

- Closing, or clearing the balances, means returning the account to a zero balance.

- However, like every accounting tool, it must be used correctly and in coordination with other accounting tools to operate smoothly and provide value.

- The retained earnings account is reduced by the amount paid out in dividends through a debit and the dividends expense is credited.

- A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months.

Income statements provide a summary of the performance of a company during a specific accounting period and are useful for various stakeholders like management, investors, lenders, and creditors. With the income statement detailing the categories of revenues and expenses of a company, management is able to see how each department of a company is performing. Non-operating expenses are the costs from activities not related to a company’s core business operations. Notice that the balances in interest revenue and service revenue are now zero and are ready to accumulate revenues in the next period. The Income Summary account has a credit balance of $10,240 (the revenue sum). Companies are required to close their books at the end of each fiscal year so that they can prepare their annual financial statements and tax returns.

Many of these come in the form of understanding what each section of the document means and interpreting it. In many cases, the computer never even shows the income summary or has a record. Externally, they are most commonly used by investors and creditors. Internally, they can be used by company executives or management teams. The company also realized net gains of $2,000 from the sale of an old van, and incurred losses worth $800 for settling a dispute raised by a consumer.

- Therefore, learning about income summaries and other accounting tools in business is imperative.

- Once the temporary accounts are closed to the income summary account, the balances are held there until final closing entries are made.

- Conversely, if the income summary account has a net debit balance i.e. when the sum of the debit side is greater than the sum of the credit side, it represents a net loss.

- The multi-step income statement reflects comprehensively the three levels of profitability – gross profit, operating profit, and net profit.

- As the tables show, this business made a profit during the accounting period.

- Then, you transfer the total to the balance sheet and close the account.

These transfers effectively reset the temporary revenue and expense accounts to zero balances, preparing them for the upcoming accounting period. At the end of a period, all the income and expense accounts transfer their balances to the income summary account. The income summary account holds these balances until final closing entries are made.

- It reports these figures by using just one equation to calculate profits.

- Non-operating items are further classified into non-operating revenue and non-operating expenses.

- With 7.45 billion outstanding shares for Microsoft, its EPS came to $9.72 per share ($72.361 billion ÷ 7.446 billion).

- The second entry requires expense accounts close to the Income Summary account.

- For our purposes, assume that we are closing the books at the end of each month unless otherwise noted.

- After the closing journal entry, the balance on the drawings account is zero, and the capital account has been reduced by 1,300.

They are also transparent with their internal trial balances in several key government offices. Check out this article talking about the seminars on the accounting cycle and this public pre-closing trial balance presented by the Philippines Department of Health. In essence, we are updating the capital balance and resetting all temporary account balances. Now for this step, we need to get the balance of the income summary account. In step 1, we credited it for $9,850 and debited it in step 2 for $8,790.

Closing Entries

![]()