Cost-benefit analysis (CBA) is a process of evaluating the costs and benefits of a particular project or decision. It involves comparing the total costs of a project or decision to its total benefits to determine whether the benefits outweigh the costs. If the benefits outweigh the costs, then the project or decision is considered cost-effective. The discount rate used in CBA can have a significant impact on the results of the analysis, and different discount rates may be appropriate for different contexts.

Five key steps in conducting a cost-benefit analysis

Although this sounds intimidating, forecasting can be easy and effective if you know where to start. For example, market research can begin with simply the main goal of using a cost-benefit analysis is to reach a checking industry outlooks. Costs and benefits need to be identified and organized into categories so you can assign a dollar value to each of them.

List and categorize costs and benefits

Also make sure to factor in an objective look at any risks involved in maintaining the status quo moving forward. Include the basics, but also do a bit of thinking outside the box to come up with any unforeseen costs that could impact the initiative in both the short and long term. In some cases geography could play a role in determining feasibility of a project or initiative. If geographically dispersed stakeholders or groups will be affected by the decision being analyzed, make sure to build that into the framework upfront, to avoid surprises down the road. Conversely, if the scope of the project or initiative may scale beyond the intended geographic parameters, that should be taken into consideration as well. Depending on the specific investment or project being evaluated, a cost-benefit analysis may require discounting the time value of cash flows using net present value calculations.

How Do You Weigh Costs vs. Benefits?

Concepts and things that are difficult to quantify, such as human life, brand equity, the environment, and customer loyalty can be difficult to map directly to costs or value. With respect to intangibles, Dr. Kaplan suggests that using the cost benefit analysis process to drive more critical thinking around all aspects of value—perceived and concrete—can be beneficial outcomes. “[Cost benefit analysis] assumes that a monetary value can be placed on all the costs and benefits of a program, including tangible and intangible returns.

Establish the framework for analysis

It is the ratio of the PV of benefits to the related costs, with a value exceeding 1 denoting net rewards. When deciding between different investment options, this method favours the project with the highest BCR. Follow up by computing the net present values by subtracting the present value of cash outflows (costs) from cash inflows (benefits). At this stage, some firms also use a cost-benefit ratio to get a better picture of the project’s dynamics. This step helps you understand the potential costs of doing nothing and can help you determine whether it is even feasible to start a new project. On the other hand, doing nothing can lead to disaster if you fall behind your competitors—doing nothing could end up costing you more than making an investment.

Best Practices for Conducting Cost-Benefit Analysis

He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and https://www.bookstime.com/ teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

- However, if one or more methods have conflicting results, a managerial decision-making process may be needed to decide whether to move forward with the project or pass on it.

- It allows decision-makers to justify their decisions based on economic principles and to demonstrate that they are using resources in a responsible and effective manner.

- An intangible cost is difficult to measure but may be something like a decrease in productivity when the new factory first begins production.

- When performing a cost-based analysis, an analyst will need to assign a dollar value to all benefits and costs in order to calculate cash flows and determine the NPV.

- It seems obvious to say, but incorrect data can skew the analysis results.

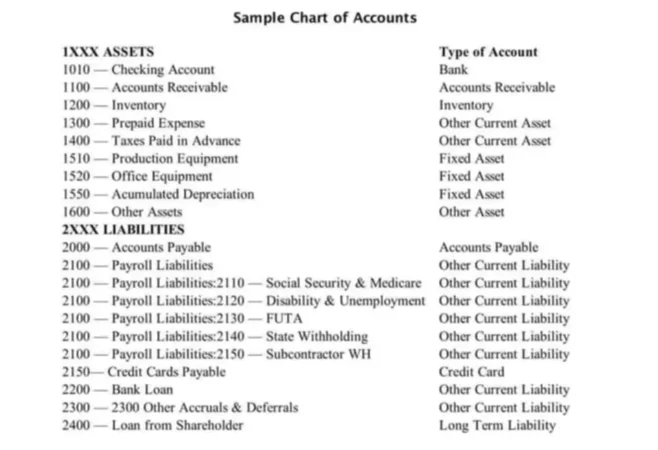

Cost-benefit analysis: Steps

Corps of Engineers in the 1930s, CBA involves comparing all current and projected costs and benefits of a project, both monetary and intangible. CBA is important because it provides decision-makers with a way to compare the costs and benefits of different options and make informed decisions. It helps to ensure that resources are allocated efficiently and that the benefits of a project or decision outweigh its costs. When listing out tangible costs (like direct and indirect costs), follow the same process you would when creating a project budget. Think of all the tasks you need to complete to follow through on your decision, then list out the resources required for each deliverable. If you’re stuck, try looking at similar projects that have been completed in the past to see what type of impact they had.

Step 3: Identify benefits

Net present value (NPV) is a calculation that takes the time value of money into account. You discount cash flow back to the present based on the following formulas, which account for each year of cash flows. An example of CBA from a business perspective is comparing the cost and benefit of adding a new product line to what you already manufacture. The benefit of adding the new product line is $300,000, which represents increased sales. As a business owner, you ask yourself whether the cost is worth the benefit.

A complete guide to effective cost benefit analysis

Recent Comments